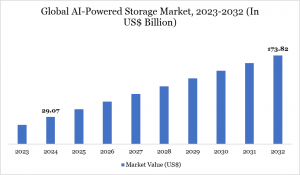

AI Powered Storage Market Set for Strong Growth to USD 173.82 Billion by 2032, Led by North America's 38% Market Share

AI Powered Storage Market surges with intelligent data management revolutionizing cloud, edge, and enterprise solutions for optimized performance and scalability.”

AUSTIN, TX, UNITED STATES, December 19, 2025 /EINPresswire.com/ -- The Global AI Powered Storage Market reached USD 29.07 billion in 2024 and is expected to reach USD 173.82 billion by 2032, growing at a strong CAGR of 25.05% during the forecast period 2025–2032.— DataM Intelligence

Market growth is driven by the rapid surge in enterprise and cloud data volumes, increasing adoption of AI-driven analytics, and rising demand for intelligent data management and automation. Additionally, growing deployment of hybrid and multi-cloud infrastructures, advancements in machine learning–based storage optimisation, and the need for real-time data processing and cost efficiency are further accelerating market adoption.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/ai-powered-storage-market

United States: Key Industry Developments

-November 2025: Pure Storage launched FlashBlade//S AI, a high-performance storage platform optimized for AI workloads, enabling faster data processing and reduced latency for enterprise AI training in data centers.

-October 2025: Dell Technologies introduced PowerStore Prime, an AI-powered storage array with predictive analytics for automated tiering and capacity optimization, targeting U.S. cloud providers and hyperscalers.

-September 2025: NetApp unveiled Astra AI Control Plane, integrating AI-driven storage management across hybrid clouds, enhancing data governance and efficiency for U.S.-based financial and healthcare sectors.

Asia Pacific / Japan: Key Industry Developments

-November 2025: Hitachi Vantara expanded its AI-powered storage solutions in Japan with adaptive data placement features, supporting high-velocity AI applications in Tokyo's tech hubs.

-October 2025: Fujitsu launched the Virtuora Multi-Cloud Orchestrator with embedded AI storage optimization, focusing on Japan's 5G and IoT data surge for smarter edge computing.

-September 2025: NEC Corporation deployed AI-enhanced storage systems for government smart city projects in Asia Pacific, improving real-time analytics and energy-efficient data handling.

Key Merges and Acquisitions:

-Dell Technologies – bolstered its AI-powered storage portfolio with the acquisition of key AI infrastructure startups in early 2025, enhancing hybrid cloud capabilities and predictive analytics for enterprise data management.

-Hewlett Packard Enterprise (HPE) – expanded its intelligent storage offerings through the strategic purchase of a specialized AI data orchestration firm in Q2 2025, accelerating scalability for AI/ML workloads.

-Lenovo Group – advanced its leadership in AI-optimized storage by acquiring innovative edge computing storage providers mid-2025, integrating liquid-cooled solutions to support high-density AI deployments.

Market Segmentation Analysis:

-By Offering: Hardware Leads with 69% Share

Hardware dominates the AI Powered Storage Market with 69% market share in 2024, fueled by demand for high-performance systems like NVMe SSDs and AI-optimized GPUs for real-time analytics and ML workloads.

This segment supports explosive data growth from AI applications, enabling faster processing and lower latency essential for enterprise-scale deployments.

Software holds the remaining 31% but grows fastest at 31% CAGR, driven by AIOps, predictive analytics, and intelligent data tiering for autonomous operations.

-By Storage System: NAS Emerges as Leader

Network-attached Storage (NAS) leads through 2035, propelled by unstructured data surge and needs for scalable, high-throughput file systems in AI/ML workflows.

It excels in parallel access and metadata handling for GPU clusters used by hyperscalers.

Direct-attached Storage (DAS) and Storage Area Network (SAN) follow, with SAN showing high CAGR for block-level performance in mission-critical apps.

-By Storage Architecture: SSDs Dominate Medium

Solid State Drives (SSDs) command the highest share and growth, due to ultra-low latency, high IOPS, and NVMe support keeping AI training GPUs saturated.

Hard Disk Drives (HDDs) hold significant revenue for cost-effective capacity in archival tiers.

Block, file-based, and object storage architectures vary by use, with object gaining for unstructured AI data lakes.

-By Storage Medium: SSDs Hold Top Position

SSDs lead with superior performance for AI's speed demands, outpacing HDDs in deployments.

HDDs retain share for high-capacity, lower-cost bulk storage.

-By End-User: Enterprises Drive Majority

Enterprises lead adoption for massive data needs in AI-driven operations, followed by Cloud Service Providers scaling hyperscale infrastructure.

Government Bodies prioritize secure, compliant storage; Others (e.g., healthcare) grow via specialized AI analytics.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=ai-powered-storage-market

Growth Drivers:

-Explosive growth in unstructured data from IoT, cloud, and AI applications demands advanced, efficient storage systems.

-Rising need for real-time processing and low-latency access to support AI workloads and high-performance computing.

-Expansion of edge computing, enabling localized data handling and reduced dependency on central clouds.

-Enhanced operational efficiency through AI automation, minimizing errors and optimizing resource allocation.

-Improved cybersecurity features like real-time threat detection and anomaly monitoring for sensitive data protection.

Regional Insights:

-North America leads the AI Powered Storage Market with the highest share at approximately 38% in 2024, driven by advanced technological adoption, robust cloud infrastructure, and the presence of major tech companies like Dell and Pure Storage. Enterprises here prioritise data protection amid rapid digitisation and financial sector AI integration, contributing to a market size of around USD 7.81 billion in 2023.

-Europe follows with a significant but lower market share, estimated at 28% based on regional breakdowns, fueled by strong data regulations like GDPR and growing investments in AI-driven storage by firms in Germany, the UK, and France. The region's focus on sustainability and enterprise automation supports steady growth, though it trails North America due to slower cloud penetration compared to the U.S.

-Asia Pacific holds about 23% share, exhibiting the fastest growth with the highest projected CAGR due to rapid digitization, robotics expansion, and surging cloud demand in countries like China, India, and Japan. Internet penetration and social media usage further boost the need for scalable AI storage solutions.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/ai-powered-storage-market

Key Players:

Dell Inc. | IBM | Pure Storage | Seagate Technology | Western Digital | NetApp | NVIDIA | Huawei | Micron | Wiwynn Corporation

Key Highlights (Top 5 Key Players) for AI Powered Storage Market:

-Dell Inc. reported USD 12.5 billion in AI-optimized storage revenues in 2025, driven by PowerStore and PowerScale platforms supporting hybrid cloud AI workloads with 35% YoY growth.

-IBM generated USD 9.8 billion from AI-powered storage solutions like Storage Scale, featuring autonomous data tiering for enterprise AI/ML pipelines and 28% adoption increase.

-Pure Storage achieved USD 7.2 billion in all-flash AI storage revenue, with Purity software enabling real-time analytics acceleration and predictive maintenance across data centers.

-NetApp recorded USD 6.9 billion in AI-integrated storage sales via ONTAP AI, unifying data fabrics for cloud-native AI training with 25% market expansion in hyperscale deployments.

-NVIDIA contributed USD 5.4 billion through AI storage accelerators like BlueField DPUs integrated with DGX systems, boosting data ingestion speeds by 40% for generative AI models.

Conclusion:

The AI Powered Storage Market is set to redefine data management with intelligent automation, predictive analytics, and seamless scalability for cloud and edge environments. As enterprises prioritize efficiency and cost savings amid exploding data volumes, AI integration ensures optimized performance and resilience. This evolution positions AI-powered storage as a cornerstone of future digital infrastructure, driving sustainable innovation across industries.

Related Reports:

1. AI in Edge Computing Market - expected to reach US$ 83.86 billion by 2032, growing with a CAGR of 22.50% during the forecast period 2025-2032.

2. AI in Telecommunication Market - expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025–2033.

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.